Operating Costs inherent in the Commercial Litigation Finance Asset Class (Part 1 of 2)

EXECUTIVE SUMMARY

Article draws comparisons between commercial litigation finance and private equity (leverage buy-out) asset classes

Similarities and differences exist between private equity and litigation finance operating costs, but there are some significant jurisdictional differences to consider

Value creation is front-end loaded in litigation finance vs. back-end loaded in private equity

Litigation finance can be a difficult investment to scale while ensuring the benefits of portfolio theory

INVESTOR INSIGHTS

The ‘2 and 20’ model is an appropriate baseline to apply to litigation finance, but investors need to understand the potential for misalignment of interests

As with most asset classes, scale plays an important role in fund operating costs

Deployment risk and tail risk are not insignificant in this asset class

Investor should be aware of potential differences in the reconciliation of gross case returns to net fund returns

Up-front management fees may have implications for long-term manager solvency

My overarching objective for Slingshot is to educate potential investors about the litigation finance asset class and to improve industry transparency, as I believe increased transparency will ultimately lead to increased investor interest and increased access to capital for fund managers. In this light, I was asked to write an article a few months back about management fees in the commercial litigation finance sector, and my immediate reaction was that it would be a controversial topic that may not even be in my own best interests—and so I parked the idea. However, the seed was germinating and I began to think about an interesting discussion of the various operating costs, including management fees, inherent in and specific to the asset class, including geographic differences therein.

While I always attempt to provide a balanced point of view in my articles, I should first point out my conflict of interest as it relates to this article. As a general partner of a commercial litigation finance fund-of-funds, and being in the design stages of my next fund offering, my compensation model is based on a combination of management fees and performance fees no different than litigation finance fund managers. Accordingly, my personal bias is to ensure that I structure my own compensation to strike a balance between investor and manager so that each feels they are deriving value from the relationship. If I overstep my bounds by charging excessive fees, I believe that a competitive market will recognize the issue and prevent me from raising sufficient capital to make my fund proposition viable. I am also kept in check by a variety of other managers in the same and similar asset classes who are also out raising money which help to establish the “market” for compensation. I further believe a smart allocator, of which there are many, will know what fee levels are acceptable and appropriate based on the strategy being employed and the resources required to deploy capital into acceptable investments (they see hundreds, if not thousands, of proposals every year, and are focused on the compensation issue). On the other hand, the litigation finance market is a nascent and evolving market with many different economic models, specific requirements and unique participants, and so a ‘market standard’ does not exist, therefore it is common to look at similar asset classes (leveraged buy-out, private credit, etc.) to triangulate an appropriate operating cost model.

At the end of the day, the most compelling philosophy of compensation is rooted in fairness. If a manager charges excessive fees and their returns suffer as a result, that manager will likely not live to see another fund. However, if a manager takes a fair approach that is more “LP favourable” in the short-term (as long as the compensation doesn’t impair its ability to invest appropriately), it can move its fees upward over time in lock-step with its performance as there will always be adequate demand to get into a strong-performing fund. There are many examples in the private equity industry of managers who have been able to demand higher performance fees based on their prior performance. So, if you have a long-term view of the asset class and your fund management business, there really is no upside in charging excessive fees relative to performance, but there is clear downside.

With my conflict disclosed, let’s move on to the issues at hand which are more encompassing than just fees.

Litigation Finance as a Private Equity Asset Class

For fund managers operating in the commercial litigation finance asset class, many view themselves as a form of private equity manager, and for the most part, the analogy is accurate. Litigation finance managers are compensated for finding attractive opportunities (known as “origination”), undertaking due diligence on the opportunities (or “underwriting”, to use credit terminology) and then stewarding their investments to a successful resolution over a period of time while ensuring collection of proceeds.

Similarly, Private Equity (“PE”) investors (for purposes of this article I refer to “Private Equity” as being synonymous with “leveraged buy-outs”, although use of the term has been broadened over the years to encompass many private asset classes) spend most of their time on origination and diligence on the front-end of a transaction, and increasingly, on value creation and the exit plan during the hold period and back-end of the transaction, respectively.

In the early days of the PE industry, the value creation plan was more front-end loaded and centered around buying at X and selling at a multiple of X (known as “multiple arbitrage”), usually by taking advantage of market inefficiency, and accentuated through the use of financial leverage and organic growth in the business. Over time, the multiple arbitrage strategy disappeared as competitors entered the market and squeezed out the ‘easy money’ by bidding up prices of private businesses. Today, PE firms are more focused on operational excellence and business strategy than ever before (during the hold period of the transaction). Having been a private equity investor for two decades I have seen a significant change in the PE value creation strategy. While organic and acquisition growth still feature prominently in PE portfolio company growth strategies, the extent to which PE managers will go to uncover value opportunities is unprecedented.

This highlights a key difference between private equity and litigation finance. In PE, the majority of the value creation happens after the acquisition starts, and ends when a realization event takes place. In litigation finance, the fund manager, in most jurisdictions, is limited from “intermeddling” in the case once an investment has been made, so as to ensure the plaintiff remains in control of the outcome of the case and that the funder does not place undue influence on the outcome of the case. Nonetheless, some litigation funders add value during their hold period by providing ongoing perspectives based on decades of experience, participating in mock trials, reviewing and commenting on proceedings to provide valuable insight, reviewing precedent transactions during the hold period to determine their impact on the value of their case, case management cost/budget reviews, etc.

Accordingly, it is easy to see that relative to private equity, the litigation finance manager’s ability to add value during the hold period is somewhat limited, legally and otherwise. One could use this differential in “value add” to justify a difference in management fees, but a counter-argument would be that in contrast to private equity, litigation finance adds value at the front-end of the investment process by weeding out the less desirable prospects and focusing their time and attention on the ‘diamonds in the rough’. Of course, private equity would make the same argument, the key difference being that in private equity there is much more transparency in pricing through market back-channeling (many of the same lenders, management consultants and industry experts know the status and proposed valuations of a given private equity deal) than what is found in the litigation finance industry. An argument can be made that inherent in litigation finance is a market inefficiency that is predicated on confidentiality, although I don’t believe that has been tested yet.

The other issue that differentiates litigation finance from PE is the scale of investing. PE scales quite nicely in that you can have a team of 10 professionals investing in a $500 million niche fund and the same-sized firm investing $2B in larger transactions, while your operating cost base does not change much, which is what allows PE operations to achieve “economies of scale”. In litigation finance, the number of very large investments is limited, and those investments typically have a different set of return characteristics (duration, return volatility, multiples of invested capital, IRR, etc.), so even if you could fund a large number of large cases, you may not want to construct such a portfolio, as large case financings will likely have a more volatile set of outcomes, so the fund would have to be large enough to allow diversification in the large end of the financing market during the fund’s investment period. Accordingly, litigation finance firms typically have to invest in a larger number of transactions in order to scale their business, and doing so requires technology, people or both. At this stage of the evolution of the litigation finance market, scale has been achieved mainly by adding people. Accordingly, as the PE industry has been able to achieve economies of scale through growth, it is reasonable for investors to benefit from those economies of scale by expecting to be charged less in management fees per dollar invested. The same may not hold true for litigation finance due to its scaling challenges, although there are niches within litigation finance that can achieve scale (i.e. portfolio financings & mass tort cases, as two examples) for which the investor should benefit.

The Deployment Problem

A third significant issue that litigation finance and investors therein have to contend with is deployment risk. In private equity, managers typically deploy most of their capital in the investment on ‘day one’ when they make the investment. They may increase or decrease their investment over time depending on the strategy and the needs of the business and the shareholders, but they generally deploy a large percentage of their investment the day they close on their portfolio acquisition. Further, it is not uncommon for a PE fund manager to deploy between 85% and 100% of their overall fund commitments through the course of the fund.

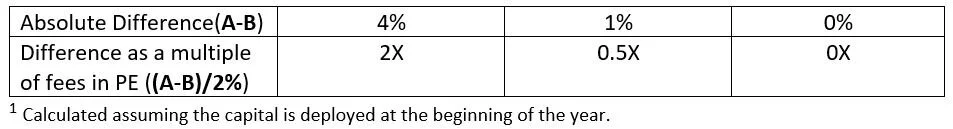

Litigation Finance on the other hand rarely deploys 100% of its case commitment at the beginning of the investment, as it would not be prudent or value maximizing to do so. Accordingly, it is not uncommon for litigation finance managers to ‘drip’ their investment in over time (funding agreements typically provide the manager with the ability to cease funding in certain circumstances in order to react to the litigation process and ‘cut their losses’). The problem with this approach is that investors are being charged management fees based on committed capital, while the underlying investment is being funded on a deployed capital basis, which has the effect of multiplying the effective management fee, as I will describe in the following example. This, of course, is in addition to the common issue of committing to a draw down type fund that has an investment period of between 2-3 (for litigation finance) and 5 (for private equity) years, for which an investor is paying management fees on committed capital even though capital isn’t expected to be deployed immediately. Litigation finance adds a strategy-specific layer of deployment risk.

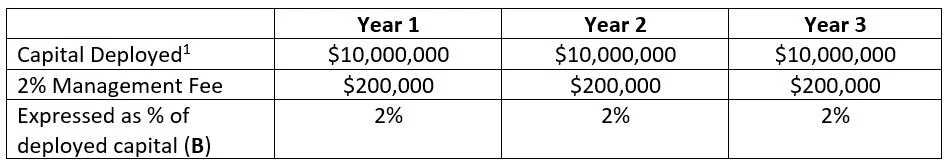

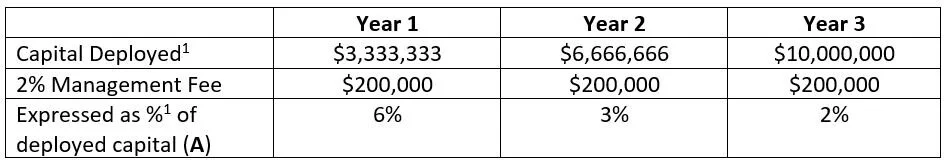

For purposes of this simplistic example, let’s contrast the situation of a private equity firm that invests $10 million on the basis of a 2% management fee model with that of a litigation finance manager that also invests $10 million, but does so in equal increments over a 3-year period.

Private Equity (PE) Model (based on a $10 million investment)

Litigation Finance Model (based on a $10 million investment evenly over 3 years)

Differences in Fees in relation to Capital Deployed

The difference highlighted above can be taken to extremes when you have a relatively quick litigation finance resolution shortly after making a commitment. In this situation, you have deployed a relatively small amount of capital that hasn’t been invested for long, but has produced a strong return – this typically results in large gross IRRs, but a relatively low multiple of capital (although the outcome very much depends on the terms of the funding agreement). While this phenomenon produces very strong gross IRRs, when the investor factors in the total operating costs of the fund, the negative impact of those costs can significantly affect net IRRs. Accordingly, investors should be aware that this asset class may have significant ‘gross to net’ IRR differentials (as well as multiples of invested capital), and one could conclude erroneously that strong gross IRRs will contribute directly to strong Net IRRs, but the ultimate net returns will vary with capital deployment, case duration. extent of operating costs and timing thereof.

I wouldn’t want this observation to discourage anyone from investing in litigation finance, but awareness of this phenomenon is important and very much dependent on the strategy of the manager, the sizes and types of cases in which they invest, and of course, is in part a consequence of the uncertain nature of litigation. As an investor, I do think it is appropriate and fair where a fund manager obtains a quick resolution, that the commitment underlying the resolution be recycled to allow the Investor a chance to re-deploy the capital into another opportunity and achieve its original portfolio construction objectives - recycling is beneficial to all involved. However, I would argue that it is not necessarily fair to charge the investor twice for the same capital, as that capital has already attracted and earned a management fee.

Stage of Lifecycle of Litigation Finance

Perhaps litigation finance is at the same stage of development as private equity experienced 20 years ago in terms of finding the “multiple arbitrage” opportunities, but a key difference is that the success rates in litigation finance are lower and the downside is typically a complete write-off of the investment, whereas private equity has many potential outcomes between zero and a multiple of their initial investment. Of course, the home runs in litigation finance can be quite spectacular. The quasi-binary nature of the asset class does present a dilemma in terms of compensation for managers and the costs inherent in running the strategy. The scale and deployment issues raised above are other issues that need to be addressed by fund managers and their compensation systems.

Notwithstanding the aforementioned, it takes highly competent and well-compensated people to execute on this particular strategy which sets a floor on management fee levels. A well-run and diversified litigation finance fund should win about 70% of their cases, and if they underwrite to a 3X multiple for pre-settlement single cases, then they should produce gross MOICs of about 2X (i.e. ~70% of 3X) and net about 1.75X (after performance fees and costs). This would be the type of performance that is deserving of a ‘2 and 20’ model as long as those returns are delivered in a reasonable time period. Conversely, if the majority of a manager’s portfolio is focused on portfolio finance investing, there may have to be a different compensation scheme to reflect the different risk/reward characteristics inherent in the diversification, scale and cross-collateralized nature of this segment of the market. One size does not fit all.

Let’s also not forget that litigation finance is delivering non-correlated returns, and one could easily assess a significant premium to non-correlation, especially in today’s market.

In Part 2 of this two-part series, I will explore the application of the ‘2 and 20’ model to litigation finance in comparison to private equity, the implication of the private partnership terms of some of the publicly-listed fund managers, and other operating costs specific to litigation finance.

Investor Insights

Any fund operating model needs to be designed taking into consideration all of the operating costs inherent in the manager’s operational model in the context of expected returns and timing thereof. Investors care about being treated fairly, sharing risk and sharing the upside performance in order to foster long-term relationships that reflect positively on their organizations’ ability to perpetuate returns. Professional investors rely on data to make decisions, and in the absence of data which might get them comfortable with a manager’s performance, they will default to mitigating risk. Tail risk in this asset class is not insignificant, which makes investing that much more difficult. A performing manager that does a good job of sharing risk and reward with investors will have created a sustainable fund management business that will ultimately create equity value for its shareholders beyond the gains inherent in its performance fees.

About The Author

Edward Truant is the founder of Slingshot Capital Inc., an investor in the litigation finance industry (consumer and commercial) and a former partner in a mid-market leveraged buy-out private equity firm. Ed is currently designing a new fund focused on institutional investors who are seeking to make allocations to the commercial litigation finance asset class.